Our Taxation Services

-

Tax Returns: Company & Individual

We handle tax returns for both companies and individuals, ensuring every detail is accurate and compliant with SARS requirements. We capture your income, expenses, and supporting documents to calculate your tax position. Our service helps you avoid penalties, maximise benefits, and submit confidently each year.

-

Submissions: VAT|UIF|PAYE

We manage your monthly and bi-monthly submissions for VAT, UIF and PAYE to keep your business fully compliant. We prepare the required calculations, submit them accurately, and ensure deadlines are met. This reduces admin stress, prevents penalties, and keeps your payroll and tax responsibilities running smoothly throughout the year.

-

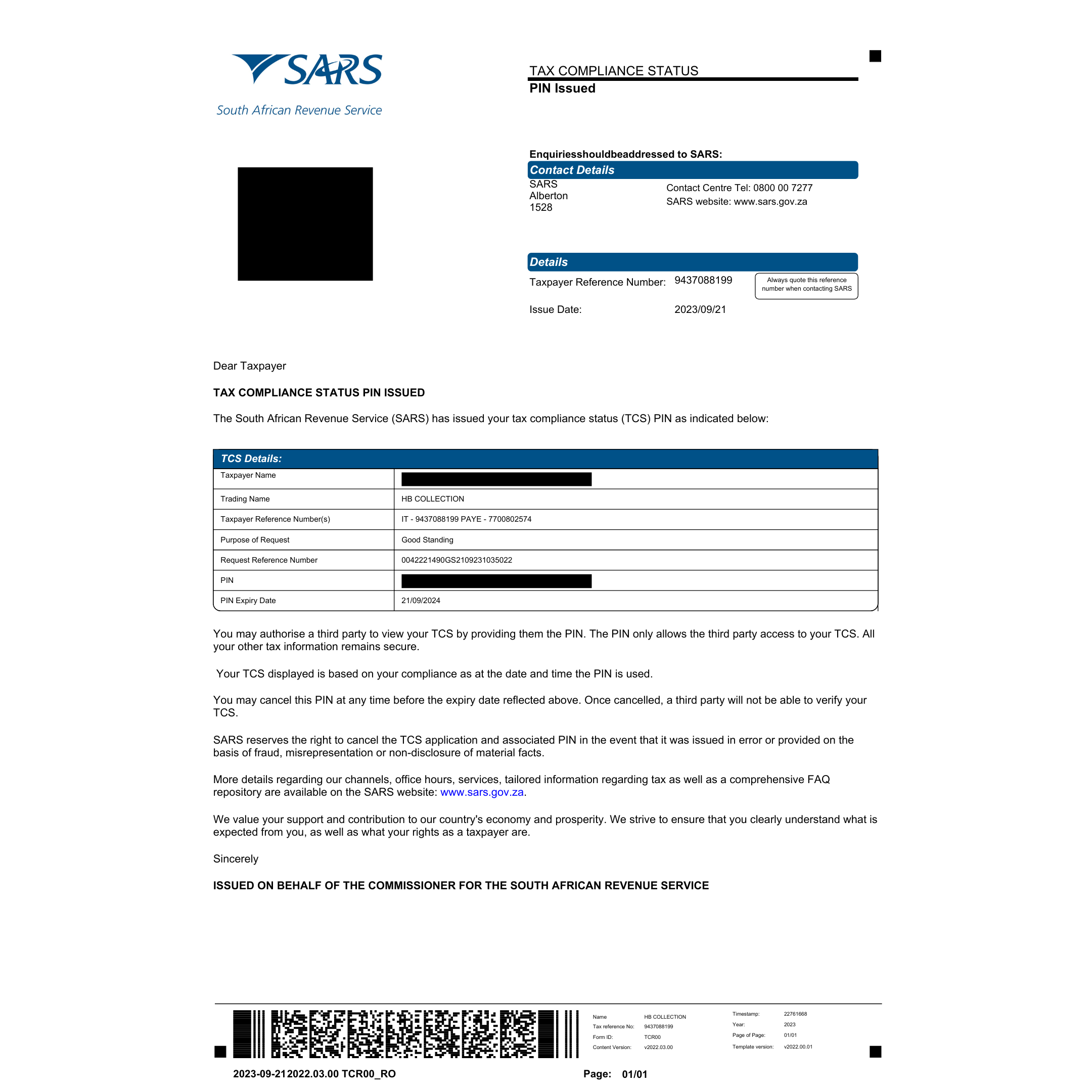

Tax Clearance Certificates

We assist with obtaining your Tax Clearance Certificate, ensuring SARS reflects your account as compliant and up to date. This certificate is essential for tenders, funding, contracts, and certain business transactions. We handle the checks, submissions and follow-ups, giving you a smooth and stress-free approval process.

-

SARS Registration & Compliance

We handle all SARS registrations, including income tax, VAT, PAYE, and UIF, ensuring your business is correctly set up from the start. We also monitor ongoing compliance to keep your accounts current. This helps you avoid issues, operate legally, and maintain a strong financial standing with SARS.

-

SARS Queries & Dispute Resolution

We assist with resolving SARS queries, letters, and assessments by reviewing your documents and preparing the correct responses. If needed, we manage objections or disputes on your behalf. Our goal is to protect your interests, correct errors, and ensure fair outcomes while reducing stress.